The Paycheck Protection Program (PPP) loan warrant list has emerged as an indispensable tool for small businesses navigating financial challenges. Launched by the U.S. government, this initiative aims to provide essential support to businesses affected by economic disruptions. Understanding the mechanics of PPP loan warrants and their implications is crucial for ensuring your business's financial resilience and growth.

In an ever-changing economic landscape, staying informed about available resources is vital for business success. The PPP loan warrant list serves as a powerful asset for entrepreneurs and business owners, enabling them to explore funding opportunities while adhering to regulatory guidelines. This article provides an in-depth exploration of PPP loans, offering practical insights and expert advice tailored to help you make informed decisions.

This comprehensive guide will delve into the critical aspects of the PPP loan warrant list, including eligibility requirements, application procedures, and the advantages of participating in the program. Whether you are an experienced business owner or a startup seeking financial backing, this resource will equip you with the knowledge you need to thrive in challenging times.

Read also:Exploring The World Of Funny Relationship Memes A Journey Through Laughter And Love

Overview of the PPP Loan Warrant List

The PPP loan warrant list plays a pivotal role in the Paycheck Protection Program, designed to assist small businesses in maintaining operational continuity during periods of economic uncertainty. This section will provide a detailed overview of the program and its importance for businesses across various sectors.

What Exactly is the PPP Loan Program?

The Paycheck Protection Program, established under the CARES Act, provides forgivable loans to small businesses to cover payroll and other essential expenses. The primary objective of this program is to help businesses retain their workforce and overcome financial hurdles caused by unforeseen circumstances. By leveraging the PPP loan warrant list, businesses can secure funding that ensures operational sustainability and fosters long-term growth.

Eligibility Requirements for PPP Loan Warrants

For businesses to qualify for PPP loan warrants, they must meet specific criteria outlined by the Small Business Administration (SBA). This section will outline the necessary conditions and requirements for participation in the program.

Key Eligibility Criteria

- Businesses must employ 500 or fewer individuals.

- Eligible entities include small businesses, nonprofit organizations, veterans organizations, and self-employed individuals.

- Applicants must demonstrate a legitimate need for the loan due to economic instability caused by unforeseen events.

A thorough understanding of these criteria is essential for businesses seeking to participate in the PPP loan program. Ensuring compliance with eligibility standards can simplify the application process and enhance the likelihood of approval.

Advantages of PPP Loan Warrants

Participating in the PPP loan warrant list offers a multitude of benefits for small businesses. This section will highlight the advantages of securing PPP loans and how they can positively influence your business's trajectory.

Forgivable Loan Terms

One of the standout features of PPP loans is the potential for loan forgiveness. Businesses can apply for forgiveness if they utilize the funds for eligible expenses such as payroll, rent, utilities, and mortgage interest. This characteristic makes PPP loans an appealing option for businesses aiming to stabilize their finances without accumulating long-term debt.

Read also:Discover The Joy Of Aging With The Funniest Senior Quotes

Steps to Apply for PPP Loan Warrants

The application process for PPP loan warrants involves several stages that demand meticulous attention to detail. This section will guide you through the process, ensuring a seamless and successful application experience.

Comprehensive Step-by-Step Guide

- Collect all necessary documentation, including payroll records, tax forms, and financial statements.

- Choose a participating lender and complete the application form meticulously.

- Submit the application along with supporting documents to the lender for evaluation.

- Monitor the status of your application and promptly address any requests from the lender for additional information.

Adhering to these steps can significantly improve your chances of securing a PPP loan and accessing the financial resources your business requires.

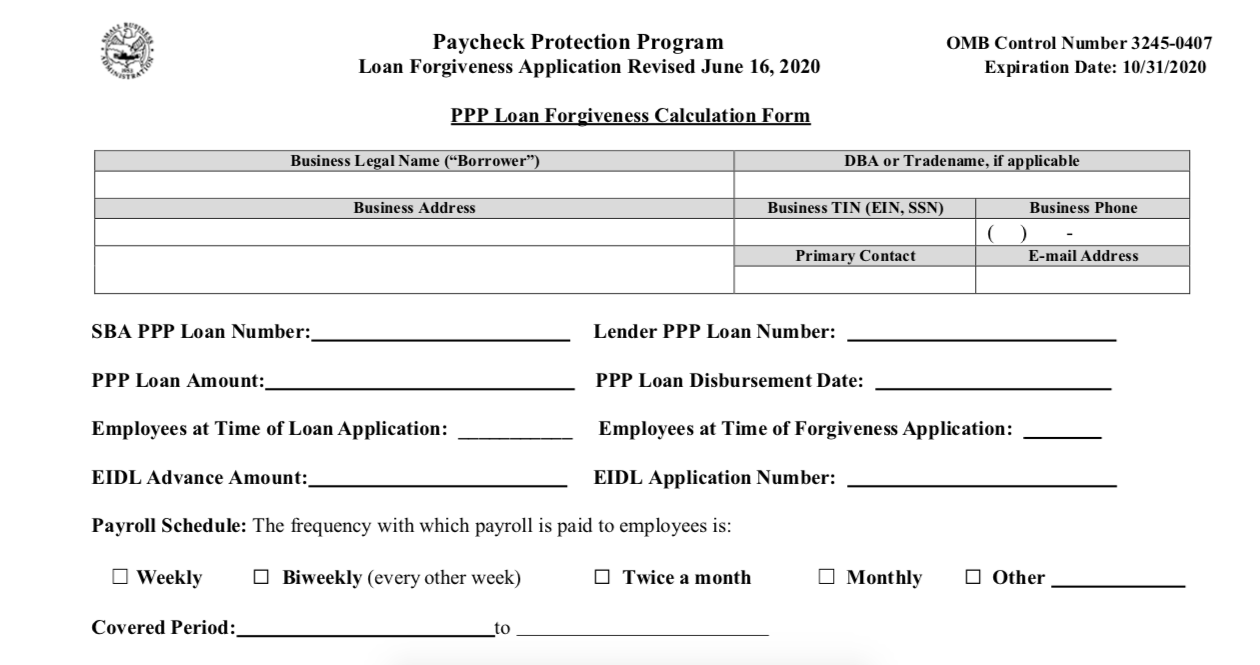

Understanding the PPP Loan Forgiveness Process

Loan forgiveness is a crucial component of the PPP loan warrant list. This section will elucidate the forgiveness process and the conditions that must be satisfied for loan forgiveness.

Conditions for Loan Forgiveness

To qualify for loan forgiveness, businesses must allocate at least 60% of the loan proceeds toward payroll expenses. The remaining 40% can be used for eligible non-payroll expenses, such as rent, utilities, and mortgage interest. Furthermore, businesses must preserve their workforce and salary levels to maximize their eligibility for forgiveness.

The Long-Term Impact of PPP Loan Warrants on Business Growth

Participating in the PPP loan warrant list can profoundly influence business growth and sustainability. This section will examine the enduring benefits of PPP loans and how they contribute to business success.

Promoting Financial Stability

By offering access to forgivable loans, PPP loan warrants empower businesses to maintain financial stability during challenging periods. This stability enables businesses to focus on growth strategies, such as expanding operations, investing in cutting-edge technologies, and enhancing customer experiences.

Addressing Common Challenges in the PPP Loan Process

Although the PPP loan warrant list offers numerous advantages, businesses may encounter obstacles during the application and forgiveness processes. This section will tackle common challenges and provide effective solutions to overcome them.

Solutions to Common Challenges

- Difficulty in finding a participating lender: Conduct thorough research and compare lenders to identify one that aligns with your business needs.

- Complicated documentation requirements: Ensure all required documents are well-organized and easily accessible before initiating the application process.

- Uncertainty regarding forgiveness eligibility: Consult financial advisors or legal experts to guarantee compliance with forgiveness requirements.

By proactively addressing these challenges, businesses can navigate the PPP loan process with confidence and achieve favorable outcomes.

Statistical Insights into PPP Loan Warrants

Data and statistics offer valuable perspectives on the effectiveness and impact of PPP loan warrants. This section will present key statistics and trends associated with the program.

Notable Statistics

According to the Small Business Administration, more than 11 million PPP loans have been approved, amounting to over $800 billion in funding. These figures underscore the program's success in supporting small businesses across diverse industries. Additionally, businesses in the hospitality, retail, and healthcare sectors have particularly benefited from PPP loans.

Expert Advice for Optimizing PPP Loan Warrants

Seeking expert advice can enhance your comprehension of PPP loan warrants and improve your capacity to leverage the program effectively. This section will provide expert insights and recommendations for maximizing PPP loan benefits.

Expert Recommendations

- Engage with financial advisors to devise a strategic plan for utilizing PPP loan funds.

- Stay updated on program updates and regulatory changes to ensure compliance.

- Regularly assess your business's financial health to evaluate the impact of PPP loans on your operations.

Implementing these strategies can assist businesses in optimizing their PPP loan experience and achieving long-term success.

Conclusion and Next Steps

The PPP loan warrant list continues to be an invaluable resource for small businesses in need of financial support and stability. By grasping the program's eligibility criteria, application process, and forgiveness conditions, businesses can capitalize on this opportunity to enhance their operations and drive growth.

We urge you to take action by exploring the PPP loan program and determining its suitability for your business. Share your thoughts and experiences in the comments section below, and explore other resources on our website to further enrich your business knowledge. Together, we can navigate the complexities of today's business environment and achieve success.

Table of Contents

- Overview of the PPP Loan Warrant List

- Eligibility Requirements for PPP Loan Warrants

- Advantages of PPP Loan Warrants

- Steps to Apply for PPP Loan Warrants

- Understanding the PPP Loan Forgiveness Process

- The Long-Term Impact of PPP Loan Warrants on Business Growth

- Addressing Common Challenges in the PPP Loan Process

- Statistical Insights into PPP Loan Warrants

- Expert Advice for Optimizing PPP Loan Warrants

- Conclusion and Next Steps

For additional information and references, consult official sources such as the Small Business Administration (SBA) and the U.S. Department of the Treasury for the latest updates on PPP loan warrants.